Send a general letter to a public authority

It is important, that the text of the letter must be written in Polish language.

First go to the website of this service

You can read an English version of the service description, but the form in the end will be already in Polish.

This leads you to this website: https://moj.gov.pl/pismo-ogolne/usluga-online/engine/ng/index?xFormsAppName=PismoOgolneDoPodmiotuPublicznego&xFormsFormName=Wniosek

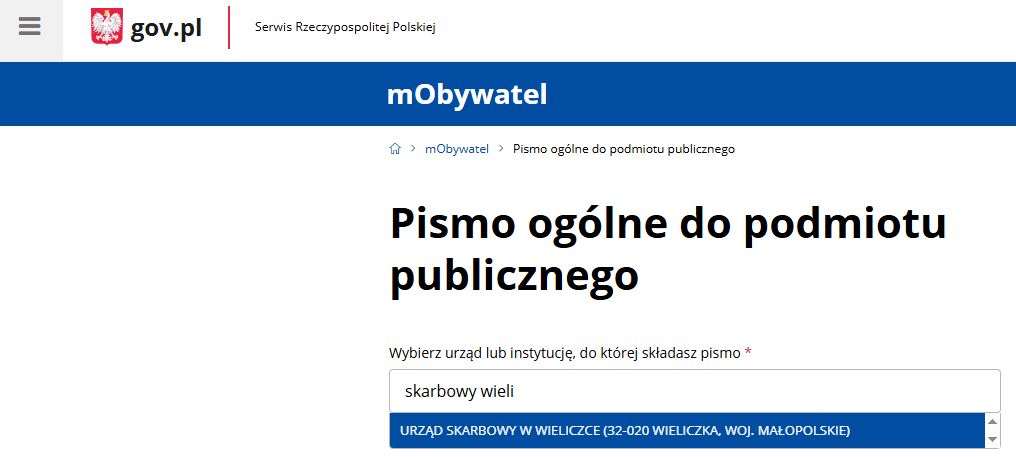

Define whom do you want to address your letter to

Choose what kind of letter are you sending

In most cases using "Wniosek" for a request or "Informacja" to send additional information e.g. to the tax office are perfect.

Add a specific title to the letter

Be specific as much as you can! If you are sending a reply in as existing case, use that case number and add what you are sending in that case

See an example below.

If you do not have a case ID or a case at all, make sure the recipient knows what you wish share with them. Add identification data (NIP, PESEL), name a related document (like "PIT-36 za 2023") and a short description.

Enter the text of the letter

Add attachments

This part is optional, unless it is requested in the letter you received. After uploading a file, specify the contents of it. File name may be descriptive, but a proper description must be added.

Check your contact details

Check your contact detail and go further with the sending.

Sign and send

On the next page you will see a proper summary of your letter, ready to be signed and sent.

Choose the "Podpisz i wyślij" option to sign and send your letter.

You will be redirected to Profil Zaufany to sign your letter by Podpis Zaufany.

The system will display a message when your letter is successfully signed and sent.

Related Articles

Self-billing with a foreign contractor

On December 9, 2025, new Regulations of the Minister of Finance and Economy concerning situations in which there is no obligation to issue structured invoices, i.e., invoices to KSeF, were published in the Journal of Laws of the Republic of Poland, ...KSeF - SCANYE - Subiekt123 full guide to integration from February 2nd, 2026

Log in to the KSeF application https://ap.ksef.mf.gov.pl/ Please use this link to log in. Log in with Profil Zaufany If you choose another method to log in, the process may be different. Enter the tax ID number of the company you are acting on behalf ...How connect Subiekt123 to KSeF by a certificate

Open Subiekt123 in your browser Log in to Subiekt123 with your InsERT account (Konto InsERT). In the upper right corner of the window, click on the KSeF icon. Click on the "Konfiguracja"(Configuration) menu, then select the "Połączenie z KSeF" ...Connecting Subiekt123 with the National e-Invoice System

Log in to Subiekt123 using your Insert account. https://app.subiekt123.pl/ Go to the “ Configuration” menu in the lower left corner. Next go to „Krajowy System e-Faktur” You will see a window with the following information: „Integracja z Krajowym ...Jak wczytać dokumenty wielostronnicowe przez aplikację mobilną SCANYE

Otwórz aplikację SCANYE na swoim urządzeniu mobilnym. Postępuj według następnych kroków: Zrób pierwsze zdjęcie. Jeśli dokument jest długi i wąski, zdjęcie zalecamy dopasować do szerokości dokumentu od nagłówku. Dodaj kolejną stronę ... i kolejne ...